Agricultural Market Analysis: Trends and Challenges for Investors in Australia

Context of the Australian Agricultural Market

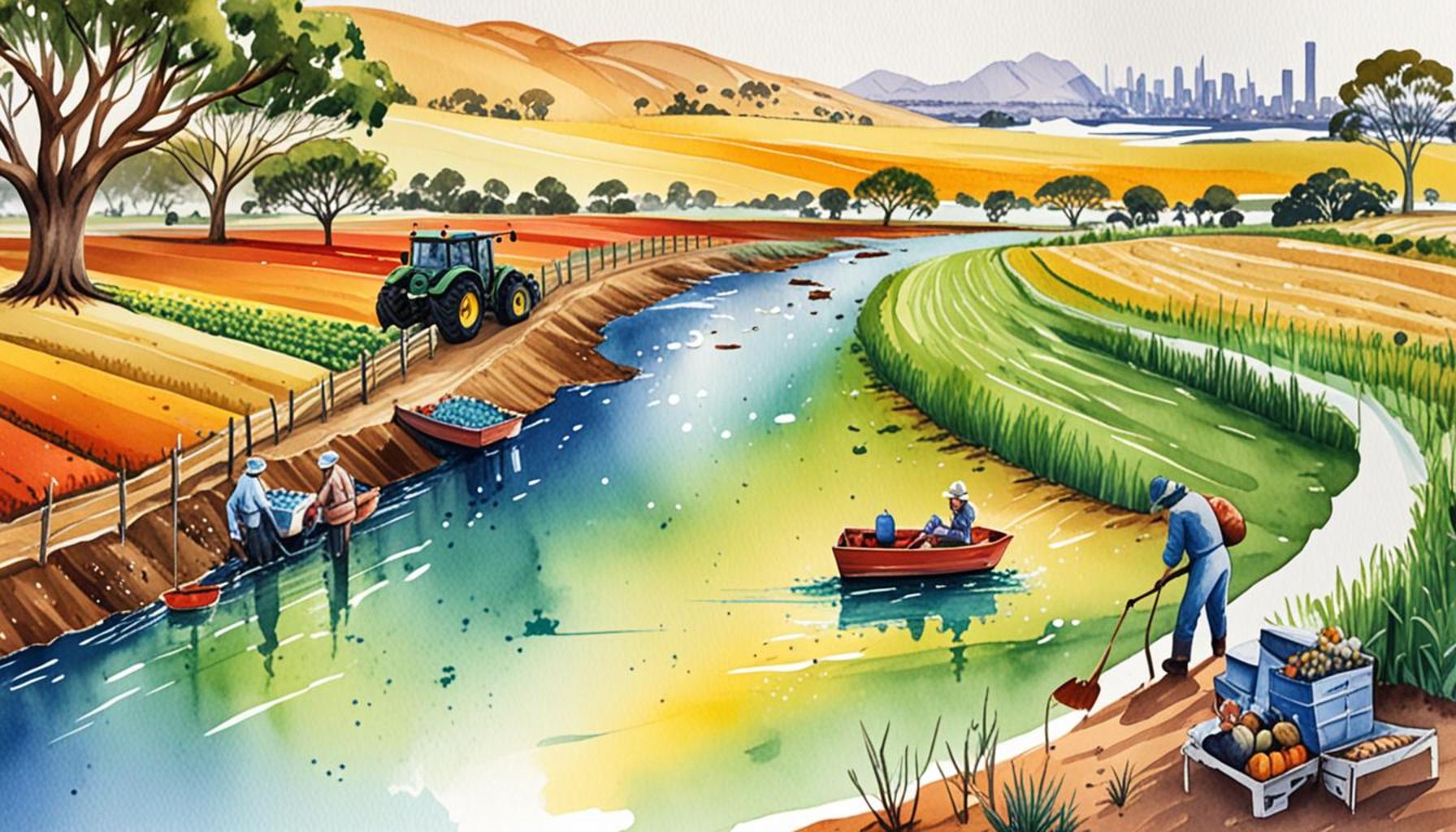

The Australian agricultural market is a vibrant and dynamic landscape that has the potential to shape the future not only of the nation but also of global ecosystems. As the world faces rising populations and finite resources, Australia holds a strategic position thanks to its vast expanses of arable land, innovative farming practices, and rich biodiversity. Yet, navigating this complex environment requires not just a keen eye for emerging trends but also a profound understanding of the various factors at play.

Opportunities in the Agricultural Sector

One cannot overlook the impact of technological advancements which are transforming traditional farming methods. For instance, the adoption of precision agriculture technologies enables farmers to use data analytics for better resource management, leading to enhanced productivity and reduced waste. Drones, sensors, and AI applications are just a few examples of how technology is allowing growers to make more informed decisions, improving both yields and profitability.

Moreover, the pressing realities of climate change have triggered a shift towards more sustainable and regenerative agricultural practices. Farmers across Australia are increasingly adopting conservation techniques, crop diversification, and innovative water management strategies to build resilience against changing weather patterns. Investing in such initiatives not only promises potential financial returns but also contributes to a more sustainable planet for future generations.

Consumer behavior is also evolving, as many people show a strong preference for organic and locally sourced produce. The demand for food that is not only healthy but sustainably grown is on the rise. This trend presents an exciting opportunity for investors willing to support farmers who adhere to ethical practices, ultimately fostering a healthier society and sustainable food systems.

Challenges to Consider

However, with great opportunities come daunting challenges. Market volatility can be an investor’s worst nightmare. Economic fluctuations, trade tensions, and drought can dramatically affect agricultural prices and profitability. Additionally, regulatory burdens can create hurdles that stifle innovation and adaptability. As such, understanding the regulatory environment is crucial for any investor looking to make their mark in this sector.

A significant challenge also lies in resource availability. Water scarcity is a critical issue in many Australian regions, with some areas relying heavily on underground aquifers. The fight for arable land is becoming fierce, as urban expansion and competing industries claim more land, pushing farmers to adapt or risk extinction.

Conclusion

Ultimately, the Australian agricultural scene is brimming with possibilities for those who are ready to take on the mantle of responsible investing. Balancing the pursuit of profit with a strong commitment to sustainability is not just an investment strategy; it is a profound responsibility towards future generations. By aligning financial pursuits with ethical considerations, investors can contribute to a resilient and sustainable agricultural future that nourishes both the body and soul of the country.

SEE ALSO: Click here to read another article

Key Trends Shaping the Agricultural Landscape

As investors look to engage with the Australian agricultural market, understanding the prevailing trends is essential for making informed decisions. Presently, several noteworthy themes are emerging that promise to redefine the sector in the years to come. These trends are not only reshaping farming practices but are also promising substantial returns for those who align their investments accordingly.

1. The Rise of AgTech Innovations

One of the most exciting trends is the proliferation of AgTech innovations. This segment of technology has garnered substantial attention and investment as it addresses various challenges faced by farmers. Startups and established companies alike are developing solutions that encompass:

- Smart irrigation systems that conserve water while maximising crop yields.

- Blockchain technology</ enhancing supply chain transparency and food traceability.

- Genetic advancements leading to higher resistance in crops against pests and diseases.

By supporting and investing in AgTech ventures, stakeholders can play an integral role in fostering innovation that benefits both producers and consumers, all while boosting their own financial prospects.

2. Sustainable Farming Practices

Another transformative trend is the increasing emphasis on sustainability. As public awareness of environmental issues rises, farmers are feeling the pressure to adopt practices that mitigate negative impacts on the land. Some examples of sustainable farming methods include:

- Regenerative agriculture that improves soil health and biodiversity.

- Organic farming that eliminates the use of synthetic pesticides and fertilizers.

- Agroforestry which integrates trees with crops for enhanced ecosystem services.

This shift towards sustainability not only caters to the growing consumer demand for eco-friendly products but also positions investors at the forefront of a vital movement towards healthier food production systems. The potential for novelty in the field is substantial, with opportunities to invest in sustainable farms and practices that will yield ethical and financial rewards.

3. Changing Consumer Preferences

The Australian consumer landscape is continuously evolving, with a noticeable preference for locally sourced and ethically produced food. This shift is prompting retailers to prioritize products that align with these values, opening channels for investors to explore the organic and local markets. The appetite for transparency in food sourcing is creating avenues for:

- Direct-to-consumer sales models that bolster farmer profitability.

- Community-supported agriculture initiatives that allow consumers to invest directly in farming operations.

- Farmers’ markets that connect local growers with eager buyers.

By tapping into the trend of conscious consumerism, investors can not only secure returns but also support community well-being and economic resilience.

In summary, the Australian agricultural market is a realm filled with dynamic trends that are ripe for investment. With technology, sustainability, and shifting consumer preferences riding high on the agenda, there has never been a more exciting time to engage with this critical sector. As we delve deeper, it becomes evident that the challenges accompanying these trends must also be thoughtfully addressed to truly harness their potential.

SEE ALSO: Click here to read another article

Challenges Facing Investors in the Agricultural Sector

While the Australian agricultural market presents a multitude of opportunities, it is crucial for investors to recognize the challenges that can impact their ventures. As the landscape shifts under the pressures of climate change, market volatility, and regulatory changes, awareness and preparedness are essential for navigating these hurdles effectively.

1. Climate Resilience

Australia’s agriculture is significantly affected by climate change, with rising temperatures, changing rainfall patterns, and increased frequency of extreme weather events posing threats to production. Regions that have traditionally been reliable for certain crops may experience unanticipated challenges, including:

- Prolonged droughts which can lead to significant yield losses and decreased farm income.

- Flooding that damages crops and erodes already fragile soils.

- Pest and disease outbreaks that become more prevalent in warmer conditions.

Investors must consider engaging in climate-resilient practices such as drought-resistant crop varieties and improved soil management strategies. This proactive approach not only protects investments but also contributes to Long-term sustainability in the agricultural sector.

2. Market Fluctuations and Commodities Volatility

The agricultural market is inherently volatile, with commodities experiencing price swings due to global demand, geopolitical factors, and trade relations. For Australian investors, this volatility can manifest in various ways:

- Changes in international market demands can lead to sudden price drops or surges, impacting profitability.

- Currency fluctuations can also affect export revenues, especially for producers relying heavily on international markets.

- Supply chain disruptions caused by external events or trade conflicts can create challenges in accessing essential resources or markets.

In this dynamic environment, investors should consider financial instruments such as hedging strategies or diversification of their portfolios across multiple commodities to mitigate potential risks.

3. Regulatory Landscapes

The Australian agricultural sector is governed by a complex web of regulations aimed at environmental protection, food safety, and biosecurity. However, these regulations can sometimes be cumbersome, leading to challenges for investors:

- Compliance with regulatory standards can require significant time and financial resources, complicating operational efficiency.

- Shifting government policies can introduce uncertainty, particularly regarding subsidies and support programs.

- Land-use regulations may limit the expansion of operations or require costly modifications to existing farming practices.

Investors need to stay informed about the evolving regulatory landscape and build relationships with local authorities and industry associations. This strategic engagement can not only help in navigating compliance issues but also enable investors to advocate for favorable policy changes that benefit the community at large.

4. Workforce and Labour Shortages

The agricultural sector relies heavily on a skilled and reliable workforce. However, Australia faces ongoing challenges related to labour shortages, particularly in regional areas. Factors contributing to this issue include:

- Skill gaps in the workforce that can hinder the adoption of new technologies and practices.

- Seasonal workforce dependency which leads to difficulties in maintaining a stable supply of workers throughout the year.

- Migration policies that may restrict access to foreign workers who are critical to meeting labour demands.

To tackle these challenges, investors may consider collaborating with educational institutions to develop training programs that enhance the local workforce’s skillsets or leveraging automation technologies that can reduce reliance on manual labour.

In conclusion, while the Australian agricultural market boasts significant investment opportunities, investors must remain vigilant in understanding and addressing these challenges. By strategizing around climate resilience, market fluctuations, regulatory compliance, and workforce development, investors can create a robust foundation for sustainable growth in this vital sector.

SEE ALSO: Click here to read another article

Conclusion

In summation, the Australian agricultural market stands at a pivotal crossroads, rich with potential yet fraught with challenges that demand close attention from investors. The trends toward sustainable farming practices and technological advancements present incredible opportunities for growth and innovation. However, the hurdles posed by climate change, market volatility, regulatory complexities, and workforce shortages underscore the necessity for a proactive and informed approach.

Investors who focus on fostering climate-resilient practices and diversifying their portfolios will not only safeguard their investments but also contribute to the long-term viability of the agricultural sector. Understanding the dynamics of market fluctuations and engaging with local communities and policymakers will enhance their adaptability to regulatory changes and operational challenges.

Moreover, addressing the pressing issue of labour shortages through collaboration with educational and technological sectors can create a skilled workforce capable of driving productivity and innovation. By taking actionable steps towards these considerations, investors can not only reap the rewards of their financial commitments but also play a significant role in shaping a sustainable agricultural future in Australia.

In this landscape of risk and opportunity, the path forward is clear: with dedication, awareness, and strategic planning, investors can harness the potential of Australia’s agricultural market to foster both economic prosperity and environmental stewardship. Let us inspire ourselves to make conscious choices that support not just immediate profit, but a flourishing agricultural community for generations to come.