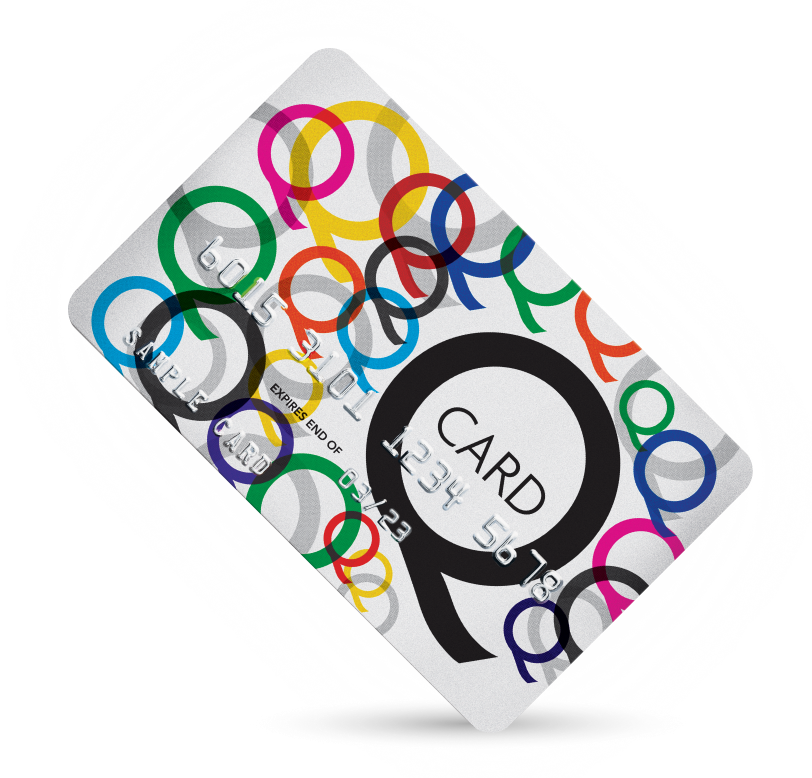

How to Apply for Q Card Credit Step-by-Step Guide Tips

The Importance of Choosing the Right Credit Card

In today’s dynamic financial landscape, selecting the appropriate credit card is vital for maintaining a healthy balance in your personal finances. With numerous options available, understanding the specifics of each card can be challenging. However, taking the time to research and choose wisely pays off in managing expenses and planning for the future.

Why Kiwis Prefer the Q Card

The Q Card has become a favored choice among New Zealanders due to its distinctive features and adaptable plans. It is crafted to offer a smooth credit experience, particularly with its generous interest-free deals, which can be a game-changer when you’re making larger purchases. Picture yourself buying a new appliance or planning a dream vacation; spreading the cost without accruing extra interest can significantly ease the financial pressure.

Flexible Repayment Options

With its easy repayment methods, the Q Card allows users to manage their finances more effectively. For instance, if you decide to refurbish your home, the card offers options where you can plan payments in a manner that suits your monthly budget without incurring immediate financial strain. This flexibility means that whether you’re making small purchases or investing in something more substantial, you have the control and the ease of structured repayments.

Application and Benefits

- Simple Application Process: Applying for a Q Card is straightforward and designed to be user-friendly, minimizing the hassle for new customers.

- Rewards and Offers: Cardholders enjoy exclusive deals, further enhancing its value as a financial tool.

These features collectively make the Q Card a compelling choice for those seeking reliable credit solutions in New Zealand. By following our detailed guide, you’ll be able to navigate the application process with confidence, unlocking a wide array of benefits designed to support your financial endeavors.

Unlock the Benefits of the Q Card

1. Interest-Free Periods

One of the standout features of the Q Card is its ability to offer interest-free periods on many purchases. This means that you can make significant purchases without the immediate pressure of interest charges adding up. For example, if you purchase a new refrigerator, you might be eligible for a 12-month interest-free term, allowing you to manage your household budget effectively over time.

Tip: Always check the specific interest-free terms available at the time of purchase and plan to clear the balance before this period ends to maximize your savings.

2. Flexible Payment Options

With the Q Card, you have access to versatile payment plans. Whether you prefer to pay over a few months or extend it to a year, the card’s flexibility helps you tailor repayments to suit your lifestyle and financial situation. This adaptability can be immensely helpful for managing everything from everyday expenses to larger outlays.

Tip: Setting up automatic payments can ensure you never miss a repayment, helping you avoid additional fees or charges.

3. Widely Accepted Across New Zealand

The Q Card is accepted at thousands of locations throughout New Zealand, both in-store and online. This wide acceptance means you have the convenience and assurance of being able to use your card in numerous places, from local retailers to online shopping platforms.

Tip: If you’re planning a shopping day, check participating stores ahead of time for any special offers or promotions exclusive to Q Cardholders.

4. Exclusive Promotions and Offers

As a Q Cardholder, you gain access to exclusive deals and promotions, providing you with the chance to save money on a wide range of products and services. These offers are regularly updated, granting you ongoing opportunities to benefit from the card’s partnerships with merchants.

Tip: Regularly visit the Q Card website or subscribe to their newsletter to stay informed about the latest promotions and make the most of your card benefits.

GET YOUR Q CARD THROUGH THE WEBSITE

| Advantage | Details |

|---|---|

| Flexibility | The Q Card allows for various repayment options tailored to individual finances. |

| Convenience | Access funds quickly for unexpected expenses, boosting financial stability. |

The Q Card is designed to provide users with a range of financial benefits, making it an attractive option for those seeking financial assistance. Its flexibility means that users can choose repayment terms that fit their income structure, reducing financial strain. This adaptability allows borrowers to regain control of their finances, an essential factor for those dealing with varying personal budgets.Additionally, the convenience of accessing funds quickly ensures that unexpected expenses do not disrupt daily life significantly. Whether it’s a car repair, emergency medical bill, or home maintenance, having the Q Card means you can handle these costs straightforwardly and without stress. This ease of process not only alleviates potential financial pressure but also provides peace of mind, encouraging users to make the best of their financial choices.

Essential Requirements for Applying for a Q Card

- Age Requirement: Applicants must be at least 18 years old. This ensures they’re legally able to enter into a credit agreement.

- Residency Status: You need to be a New Zealand citizen or have permanent residency. This is crucial as the Q Card is specifically tailored for individuals residing in New Zealand.

- Credit History: A good credit score is typically required. Your credit score reflects your ability to manage loans and credit responsibly, which is key for approval.

- Proof of Income: Documentation showing a stable income is necessary. This can include recent payslips or a letter from your employer, confirming you have the funds to meet payment obligations.

- Identification Documents: You’ll need to provide copies of valid identification such as a passport or driver’s license, to verify your identity.

GET YOUR Q CARD THROUGH THE WEBSITE

How to Apply for a Q Card Credit Card

Step 1: Visit the Q Card Website or a Participating Retailer

To begin your application for the Q Card credit card, the first step is to visit the official Q Card website or head to a participating retailer in New Zealand. You can find a list of participating retailers on the Q Card website. If you prefer the convenience of an online application, browse to their website where you’ll find a plethora of information about their credit card offerings.

Step 2: Understand the Requirements

Before you proceed with your application, it’s crucial to understand the basic eligibility requirements for the Q Card. You must be at least 18 years old, be a New Zealand resident, and have a valid form of ID such as a passport or driver’s license. Additionally, you’ll need to demonstrate a source of regular income. Knowing these prerequisites in advance helps prevent any delays in your application process.

Step 3: Complete the Application Form

When you’re ready to apply, fill out the application form with accurate personal and financial information. This can typically be done online through the Q Card website. Be prepared to provide details such as your current employment information, income details, and bank account numbers. Ensuring all information is precise will help speed up the processing time.

Step 4: Await Approval and Receive Your Card

After you’ve submitted your application, the Q Card team will review your details. This process may take a few business days. If approved, you’ll receive a notification, and your Q Card will be sent to you in the mail. Once you have your card, you can start enjoying the benefits and features it offers, such as easy financing options at numerous stores.

Remember: Always read the terms and conditions carefully before finalizing your application to fully understand your responsibilities and the card’s benefits.

Frequently Asked Questions About the Q Card

What is a Q Card and how does it work?

A Q Card is a consumer finance credit card designed to help you make purchases without needing to pay the full amount upfront. It offers the convenience of making purchases and spreading payments over time. With the Q Card, you can benefit from interest-free terms and manage your budget more effectively. For example, if you purchase an expensive appliance, you can pay it off over several months without incurring extra interest, provided you meet the specified payment terms.

Where can I use a Q Card in New Zealand?

The Q Card is accepted at a wide range of stores across New Zealand, including many popular retailers in the areas of electronics, furniture, and automotive services, among others. You can also use your Q Card for online shopping at participating retailers. It’s always a good idea to check if a retailer accepts Q Card before making a purchase to ensure a smooth transaction.

What are the interest rates and fees associated with the Q Card?

The Q Card can feature interest-free terms for a certain period, typically ranging from 3 to 24 months, depending on the promotion offered by the retailer. However, after the interest-free period expires, a standard annual purchase interest rate will apply. Additionally, there may be fees such as account maintenance fees and establishment fees. It’s important to read the terms and conditions carefully to understand the potential costs involved.

How do I apply for a Q Card?

Applying for a Q Card is straightforward. You can either apply online through the Q Card website or obtain an application form from participating retailers. Make sure to have your identification and proof of income ready as part of the application process. Credit criteria apply, so ensure that you meet the requirements for approval, such as having a good credit history and sufficient income to manage repayments.

How can I manage my Q Card payments effectively?

To manage your Q Card payments effectively, it’s crucial to make at least the minimum payment each month by the due date to avoid late fees and to maintain your interest-free status, if applicable. You can also set up direct debits from your bank account to ensure regular monthly payments. Additionally, monitoring your spending and maintaining a budget can help prevent any financial strain associated with credit card use.